Cash ISA vs Lifetime ISA: Which should I pick?

If you’re saving for your first home, the right savings account can make a huge difference to how quickly you reach your goal. Two of the most popular tax-free options are the Cash ISA and the Lifetime ISA (LISA), but how do they differ, and which one should you choose?

In this guide, we’ll compare the two side-by-side and help you decide which is best for your goals, whether that’s buying your first home or growing your savings for the future.

Why do I need an ISA?

An ISA (Individual Savings Account) is one of the most tax-efficient ways to save. Any interest or returns you earn are completely tax-free, making a big difference over time, especially as your savings grow.

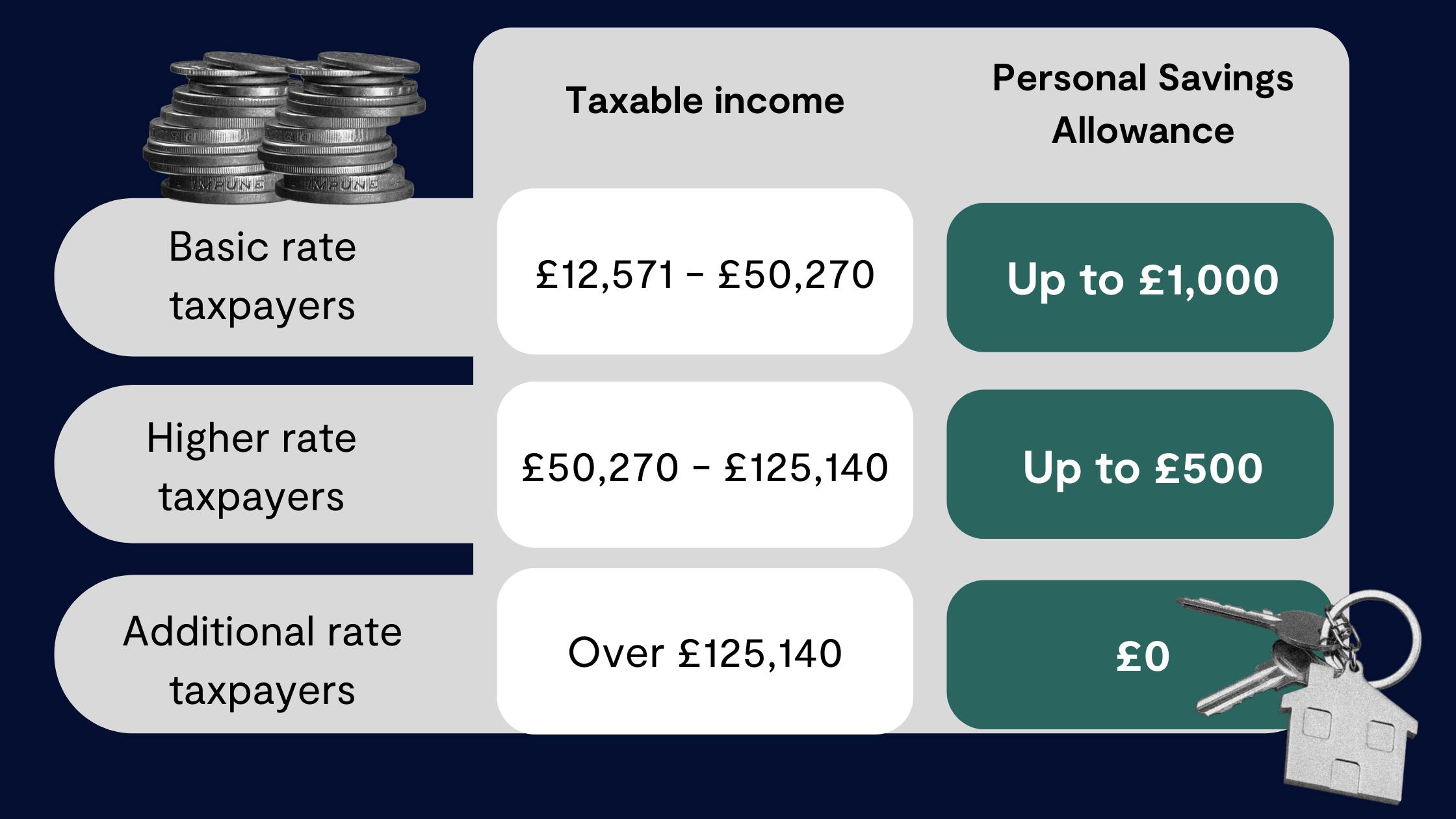

Without an ISA, the interest you earn in a standard savings account could be taxed if it exceeds your Personal Savings Allowance (PSA) - the amount of interest you can earn each year before you start paying tax. Your PSA depends on your tax bracket. For example:

- Basic rate taxpayers: £1,000 interest tax-free

- Higher rate taxpayers: £500 interest tax-free

- Additional rate taxpayers: £0 (no PSA)

With an ISA, there’s no tax to pay at all, no matter how much interest or investment growth you earn. That means every penny of growth stays in your pocket. Explore our range of ISAs here.

Earn 3.8% AER (variable) on your savings with our Easy Access Cash ISA

Save up to £20,000, tax-free every year with a Tembo Cash ISA, and benefit from our 3.8% AER (variable) interest rate. Open with as little as £10!

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

How does the £20,000 ISA allowance work?

Each tax year, you can save up to £20,000 across all your ISAs. This includes:

- Cash ISAs

- Stocks & Shares ISAs

- Lifetime ISAs

- Innovative Finance ISAs

It’s up to you whether you place the full £20,000 allowance in one type of ISA or split it across multiple ISA types. Keep in mind that the Lifetime ISA limit is lower than the others, standing at just £4,000 a year. So if you max out your Lifetime ISA in the current tax year, you’ll need to place any additional savings in other ISA types or wait until the following tax year to continue saving in your LISA.

Once the tax year restarts, so does your ISA allowance. So if you’ve used up your £20,000 allowance in the last tax year, as soon as the new tax year starts you can save an additional £20,000.

What’s the difference between a Cash ISA and a Lifetime ISA?

Both ISAs offer tax-free savings, but they work quite differently. Lifetime ISAs are a special type of ISA designed for you to save for your first home or retirement. You can save up to £4,000 each tax year into a Lifetime ISA, and the government will give you a free 25% bonus on top of whatever you save, up to £1,000 per tax year. But, if you withdraw funds from a Lifetime ISA for any other purpose than your first home purchase or retirement, you’ll be hit with the 25% government withdrawal penalty.

A Cash ISA is much more flexible. You can save for whatever you want, and save up to £20,000 each tax year. You won’t get a free 25% government bonus on your savings, but you will earn interest on your savings, which can add up substantially if you save with a competitive rate.

If you choose an Easy Access Cash ISA, you can also withdraw your funds whenever you want (allowing the time it takes for the provider to process the withdrawal). With a Fixed Rate Cash ISA, you’ll agree to lock away your funds for a set period of time, and won’t be able to withdraw your funds in return for a fixed interest rate that won’t change.

Keep reading: When can I withdraw money from a Lifetime ISA?

Earn 2.7x more interest than the Big 4 banks with our competitive, easy access Cash ISA

Save up to £20,000, tax-free every year with a Tembo Cash ISA, and benefit from our 3.8% AER (variable) interest rate. That's almost £400 more in interest over 5 years than if you were to save with the Big 4 banks*! Plus, unlimited withdrawals, fee-free mortgage advice, and monthly paid interest. Open with as little as £10!

What is better, ISA or LISA?

Whether a ISA or LISA is better depends on your goal. A Cash ISA offers more flexibility, as you can access your money at any time (assuming it’s an easy access ISA) and use it for anything. While Lifetime ISA comes with a generous 25% government bonus on your savings, but also a 25% penalty for ineligible withdrawals, which can leave you with less than you put in.

If you’re saving for your first home (worth £450,000 or less) or for retirement, the Lifetime ISA usually comes out on top. The 25% government bonus gives your savings an instant boost, helping you reach your goal faster.

If you’re saving for shorter-term goals like holidays, emergencies, or home improvements, a Cash ISA might be the better choice. It allows easy access to your money without any withdrawal penalties.

If you’re saving for retirement, a pension may be more rewarding, especially if your employer will contribute. If you’re self-employed and you therefore don’t have access to a workplace pension, a Lifetime ISA could be a good alternative, but it’s a good idea to compare the LISA bonus to the amount of tax relief you’d earn on a private pension first, particularly if you’re a higher or additional-rate taxpayer.

To learn more, take a look at our Cash Lifetime ISA vs Stocks and Shares Lifetime ISA guide.

Can I lose money in a Lifetime ISA?

If you open a Cash Lifetime ISA, your savings are protected, and you’ll earn interest much like a standard savings account. However, if you open a Stocks & Shares Lifetime ISA, the value of your investments can rise or fall depending on market performance.

There’s also the 25% government withdrawal charge to be aware of. This applies if you take money out of your LISA before age 60 or for reasons other than buying your first home. The penalty means you’ll lose the government bonus and a portion of your own savings, effectively a 6.25% loss on what you paid in. That’s why it’s important to only open a Lifetime ISA if you’re confident you’ll use it for a first home or retirement.

Perfect for you: I saved a £30,000 house deposit in four years. Here’s how I did it.

Is a LISA a no-brainer?

For most first-time buyers, yes. The Lifetime ISA really is unbeatable, as long as you use the money for an eligible house purchase. From our own data, we found that first-time home buyers purchasing using a Lifetime ISA bought four years earlier than those who didn’t use a LISA to buy.

“You’ll earn tax-free interest with a Lifetime ISA, the same as with a Cash ISA, plus a free 25% government bonus. That means if you save the maximum £4,000 per tax year, you’ll get £1,000 free from the government every year, until you turn 50.”

- Shahi Sattar, Director of Savings

However, a LISA isn’t for everyone. You should think carefully before opening one if:

- You might need to withdraw your savings early

- You plan to buy a home worth more than £450,000

- You are likely to buy within the next 12 months (as you must hold the LISA for at least a year before using it for a home purchase)

If you think you’ll need access to your savings sooner, stick with a Cash ISA instead.

Learn more:How much should I have in savings?

Can I have a Cash ISA and a Lifetime ISA?

Yes, you can have a Cash ISA and a Lifetime ISA. In fact, this could be the best approach, as you can open and pay into both as long as you stay within the overall £20,000 ISA allowance.

For example:

- £4,000 into a Lifetime ISA (earning your 25% bonus)

- £16,000 into a Cash ISA (for flexible, penalty-free savings)

This combination gives you the best of both worlds: government-backed growth and easy access when you need it.

Save for your first home with the market-leading Cash Lifetime ISA

Open an account with just £10 or transfer today to start benefitting from our market-leading interest rate of 3.8% AER (variable). Helping you to save for your first home, faster.

*Based on saving £100 at the beginning of each month for 5-years. Calculations show at month 61 (after 5-years) Tembo customers saving at 3.80% would have £390.68 on average more than saving with Barclays, HSBC, NatWest or Lloyds. Accurate December 2025.