What is interest coverage ratio?

Robert Yeo, Buy to Let specialist

Robert Yeo, Buy to Let specialistWhen researching buy to let mortgages and how to become a landlord, you might have come across the phrase ‘interest coverage ratio’. This guide explains what this means and how it impacts a borrower's ability to get a buy to let mortgage.

Key Takeaways

- Definition: Interest Coverage Ratio (ICR) is a metric used by lenders to ensure rental income can cover mortgage interest and other costs.

- Standard Requirement: Most buy-to-let lenders typically require an ICR of at least 125%.

- Calculation: It is calculated by dividing Earnings Before Interest and Taxes (EBIT) by total interest expenses.

- Improvement Strategies: ICR can be improved by increasing rental charges, reducing loan size, or improving credit score to access lower rates.

What is interest coverage ratio?

Interest coverage ratio, sometimes abbreviated to ICR, is a metric that shows whether a borrower can pay off their debts, expressed as a percentage. It’s used for companies as an indicator of their financial health, but also for individuals.

For example, for buy to let landlords, their interest coverage ratio reflects the amount of gross rental income they need to break even after factoring in mortgage repayments, tax, property maintenance and other costs. With average buy to let mortgage rates currently around 4.92% (as of January 2026), landlords need to ensure their rental income adequately covers these expenses.

Normally, landlords need an ICR of 125%. This is why mortgage lenders will typically let borrowers take out a loan that’s equivalent to 125% of their rental income.

Calculate your max borrowing capacity

Create a free Tembo plan to see what you could borrow for a buy to let mortgage today.

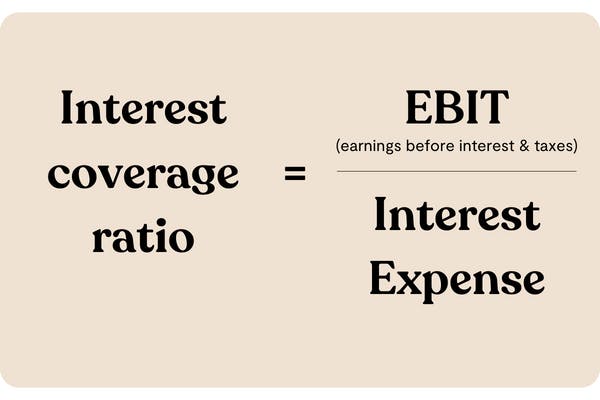

How to calculate interest coverage ratio

Interest coverage ratio is calculated by dividing your total income before interest and tax (also known as EBIT) by the total amount of interest on all of your outstanding debts. For buy to let landlords, this means comparing their annual rental income to their mortgage interest rates and monthly repayments.

Interest coverage ratio formula

Interest coverage ratio (ICR) = EBIT ÷ interest expense

To show it as a percentage, multiply the result by 100.

What is a good interest coverage ratio?

Normally, the higher a borrower's interest coverage ratio, the better. This is because a high interest coverage ratio indicates that a borrower is financially able to pay their interest expenses. For buy to let landlords, this means they can comfortably afford to pay their monthly repayments to their lender through their rental income. Typically, lenders would expect borrowers to have an ICR of 125% to qualify for a buy to let mortgage.

How to improve your interest coverage ratio

To improve your interest coverage ratio, you either need to increase your income before tax, or reduce your interest expense. For those wanting to become landlords, or who already own a buy to let property, this means either increasing your income through charging a higher rate of rent or supplementing your rental income with your personal income (for example, through top slicing).

There are various ways to get access to a lower mortgage interest rate and improve the interest coverage ratio:

- Reduce loan size: Borrowing less money decreases monthly interest obligations.

- Improve credit score: A higher score often unlocks lower interest rate products.

- Increase deposit: Putting down a larger down payment reduces the overall loan-to-value (LTV).

- Top slicing: Supplementing rental income with personal income to meet lender requirements.

If your interest coverage ratio is not high enough to qualify for a buy to let mortgage, or you're struggling to remortgage your buy to let property, we can help. Tembo is an award-winning mortgage broker that specialises in helping buyers and homeowners boost their affordability to find the best mortgage deal for them.

Need help affording a buy to let?

Create a free Tembo plan today for a personalised buy to let mortgage recommendation, from the UK's Best Mortgage Broker four years running.